In a perfect world, people injured in car accidents would be able to do nothing more than rest and focus on healing. But in the real world, injured people must also handle financial matters. Dealing with insurance companies and claim denials is part of that process.

While you might think that you have an excellent claim, car insurance companies often deny claims. This post will discuss nine reasons why insurance companies deny accident claims and tell you how a car accident lawyer can help you fight back against claim denials.

At Collins Law, LLC, we help Alabama accident victims challenge wrongful claim denials. If your insurance claim was denied, call us today at (205) 588-1411 for a free consultation.

How Car Insurance Claims Work in Alabama

A car insurance policy does two things. First, it allows you to file car accident claims against your own policy for losses. Second, most policies also allow other drivers to file claims against you for damages you caused.

On this second point, fault is the key. This is especially true in Alabama. Some states follow a “no-fault” rule, where insurance companies pay regardless of fault. But Alabama is an “at-fault” state. This means that the insurance company will not pay you unless it determines that the other driver caused the accident.

Even more important, Alabama follows a rule called “contributory negligence.” Most states allow an injured person to recover damages even if they were partially responsible for causing the accident. But under Alabama’s contributory negligence rule, a driver who is even one percent at fault cannot recover.

All of this means that car insurance companies (and the adjusters and investigators that work for them) put a lot of effort into figuring out who is at fault. If they can prove that their insured was not at fault, it helps them avoid payment.

Beyond fault, insurance investigations also look for other reasons to deny payment. Many of these reasons will be outlined below. Note that this is not a complete list and that an accident lawyer may be able to help you fight back in a claims dispute.

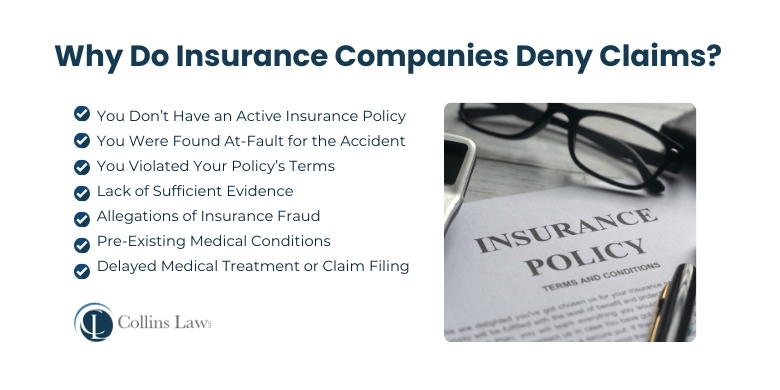

Top Reasons Why Insurance Companies Deny Claims

1. You Don’t Have an Active Insurance Policy

You cannot file a claim against a non-existent policy. Two common issues arise here. The first issue occurs when you have an insurance policy, but the payments have lapsed. The second issue is that you do have insurance, but it doesn’t cover what you think it does. For instance, if your policy doesn’t cover flood damage, you cannot make a claim based on that reason.

To prevent a claim denial on this ground, make sure that your insurance payments are up to date. Also, review your policy regularly – especially during renewal periods – to ensure that your policy covers everything that you believe it should. (Be sure to choose uninsured/underinsured motorist coverage if given the option.)

2. You Were Found At-Fault for the Accident

As stated above, Alabama is an at-fault state and a contributory negligence state. This means that if there is any evidence that you caused the accident, your claim will be easily denied.

3. You Violated Your Policy’s Terms

All insurance carriers limit what drivers can and cannot do. For instance, most personal auto coverage policies do not cover commercial vehicles or uses. So, if you rent a commercial vehicle and get into an accident, your personal insurance policy will not cover it. So, the company will deny the claim.

4. Lack of Sufficient Evidence

It’s not enough to say that you were injured. Your claim must include proof of the injuries. Doctor’s notes, x-rays, and other such documents usually suffice. If your claim has no proof – or if the proof you submitted contradicts your claims – the claim will be denied.

5. Allegations of Insurance Fraud

When it comes to insurance claims, the cliché “Honesty is the best policy,” applies. If you falsify any information in your insurance claim, it will be denied. But the insurance company won’t limit itself to the time of the accident. During the investigation, it will look at many things. If the investigation discovers that you lied about something years ago – even as far back as when you received your quote – your claim will be denied. They may also cancel your policy.

6. Pre-Existing Medical Conditions

In general, if a person causes an accident, the law holds them responsible for making their victims’ injuries worse. However, if you were injured before the accident or had a preexisting condition, the insurance company may argue that the old injury is the cause of your pain, not their driver. They will likely make the same arguments if you recently had surgery on that body part or if it had a chronic, preexisting condition before the accident.

7. Delayed Medical Treatment or Claim Filing

Did you refuse to call the police at the time of the accident? Did you wait a long time before calling the insurance company? Did you unreasonably delay seeking medical treatment?

While you may have had a good reason for making these choices, insurance adjusters view these delays as red flags. In their mind, a person who is truly injured will act immediately but a person who is faking might not. This is a common reason why insurance companies deny accident claims.

To avoid this outcome, seek medical treatment as soon as possible after an accident. (Do so even if you feel “fine,” as many injuries take days or weeks to appear.) Always call 911 after an accident and get a police report. Contact the insurance company as soon as you are able to do so. (But be careful what you say when you speak to them.)

What to Do If Your Insurance Claim Is Denied

If the insurance company denies your claim, don’t despair. There are things that you can do.

First, find out exactly why the company denied your claim. Ask for a letter that states the reasons for the denial. If you feel that there was a mistake, you might be able to send more information, such as the accident report.

Second, consider filing an appeal. All insurance companies have procedures for appealing decisions. Review your policy to learn your company’s rules. A car accident lawyer can help you with the appeal.

If the appeal fails, you may still have options, especially if you think your insurer is acting in bad faith. “Bad faith” means that the insurance company’s refusal is not based in fact but is an unreasonable attempt to avoid its legal obligations. Bad faith occurs in many circumstances, such as: denying a claim without investigation, losing paperwork, misconstruing the language of an insurance policy to avoid payment, refusing requests for documentation, or refusing to provide a written explanation for the denial.

If you believe that the insurance company is acting in bad faith, you can file a complaint with the Alabama Department of Insurance. You can also ask a Birmingham personal injury attorney to sue the insurance company.

Get Legal Help for a Denied Insurance Claim

I hope you found this discussion of the reasons why insurance companies deny accident claims helpful. If you’ve been injured and the insurance company has denied your claim, contact Collins Law, LLC. The injury lawyers at our firm can help you deal with insurance companies, car accident claims, and all other aspects of your personal injury case. To learn more about how we can help, call (205) 588-1411 or click here today to schedule a free consultation.